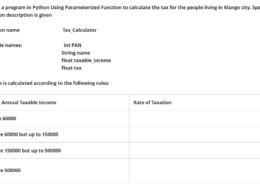

Design a program in Python Using Parameterized Function to calculate the tax for the people living in Mango city. Specify a Function description is given below:

Function name Tax_Calculator

Variable names: int PAN

String name

float taxable_Income

float tax

The tax is calculated according to the following rules:

| Total Annual Taxable Income | Rate of Taxation |

| Up to 60000 | 0% |

| Above 60000 but up to 150000 | 5% |

| Above 150000 but up to 500000 | 10% |

| Above 500000 | 15% |

1 Answer